Although price rises have been slowing down, inflationary pressures continue to be higher than normal as a result of a range of global and national factors. As we shared with you in September 2023, this will continue to affect your NHS Property Services (NHSPS) property costs as we enter 2024.

The update below outlines any known increases in your NHSPS property costs. Our efforts to drive value will continue to mitigate, wherever possible, the inflationary impact on our costs.

We know this continues to be a very challenging period for everyone and we’re here to support you. If you have any questions about your NHSPS property costs, our Customer Service team is available to help

You can contact them via:

Update on NHSPS property costs for 2023/24

Energy and business rates cost

In 2023/24, we budgeted for significantly higher energy costs and increased business rates.

Energy costs were expected to be markedly higher than in the 2022/23 budget, with a 300% increase in gas and 98% in electricity. Business rates were expected to see increases ranging from 15% to 30% compared to 2022/23 levels.

However, in the first six months of the year, energy markets have shown a consistent downward trend, which we have been able to capitalise on through our energy procurement strategy. We’ve also secured lower business rates than originally projected.

As these costs were materially lower than budgeted, rather than waiting for the 2023/24 annual reconciliation (Q2 2024) to share the savings in energy and rates with customers, if applicable, we passed them through in October and November in a one-off rebate.

What is the current position for the second half of the year?

The latest position is that energy costs are expected to be slightly higher than Q3 and Q4 budgeted costs, approximately 5% more for electricity and 10% more for gas.

This is because in the second half of the year, costs are usually higher due to the colder weather, however quarterly customer charges remain the same as in the first half of the year. This is subject to change based upon market conditions and actual consumption.

The overall position for the full year is that energy costs are expected to be materially lower than budgeted (30% in gas and 5% in electricity).

Regarding business rates, we continue to see lower average costs than originally projected so we will issue a further rebate in February/March of a similar level to the previous one. This will not apply to customers in leasehold properties where business rates are managed by the superior landlord.

Overall, we expect the remaining costs to be broadly aligned to the budgeted figures, however there may be increases / decreases on a property-by-property basis depending on each individual property circumstance. The balancing charges, including the actual costs for energy and business rates, will be confirmed when the annual reconciliation for 2023/24 is completed in June/July of this year.

Update on NHSPS property costs for 2024/25

Excluding energy, we expect our property costs to be 4% higher than the 23/24 adjusted budget (including the business rates rebates). Our efforts to drive value will continue to mitigate, wherever possible, the inflationary impact on our costs.

What are the expected energy prices for 2024/25 if my energy is supplied by NHSPS?

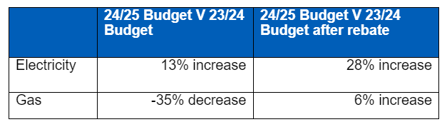

- The table below outlines the estimated average variances for energy prices during 2024/25 compared to the 2023/24 budget and the 2023/24 budget adjusted by the rebate already issued. This is an average and will vary depending on your energy use and final market conditions.

- We will continue to monitor energy markets and identify opportunities to provide best value for our customers through their energy bills.

- Through our Delivering a Greener NHS Programme, NHSPS is committed to investing in energy efficiency initiatives and supporting customers to reduce their carbon emissions and energy costs. Further information is available on our Green Plan webpage.

Independent energy brokers

- We’re aware that independent energy brokers are contacting customers stating that savings can be achieved if switched to a new provider.

- We urge caution when engaging with these organisations, as the broker industry is not regulated and will include the use of commission.

- If you are contacted by a broker and are unsure what to do, please contact us.

Questions?

We understand this is a challenging time for everyone and we’ll continue to send updates as and when we can.

If you'd like to speak to someone about your property bill or your costs, please get in touch with our Customer Service team and they'll be happy to help.